Consultation Paper on the proposed replacement of the current Fiduciary Rules, 2020 by the new Fiduciary Rules, 2021

Results updated 15 Sep 2021

Feedback statement on the new Fiduciary Rules, 2021 Consultation Paper

We asked

We asked for feedback on proposals to replace the current Fiduciary Rules, 2020 (and certain other associated secondary legislation as set out in the Consultation Paper) with the Fiduciary Rules, 2021.

You said

Eleven responses were received from a cross section of industry, including licensees, a law firm and industry representative bodies.

We did

Proposals relating to the re-categorisation of fiduciary licences.

A summary of the feedback received, together with the Commission’s responses, are presented below.

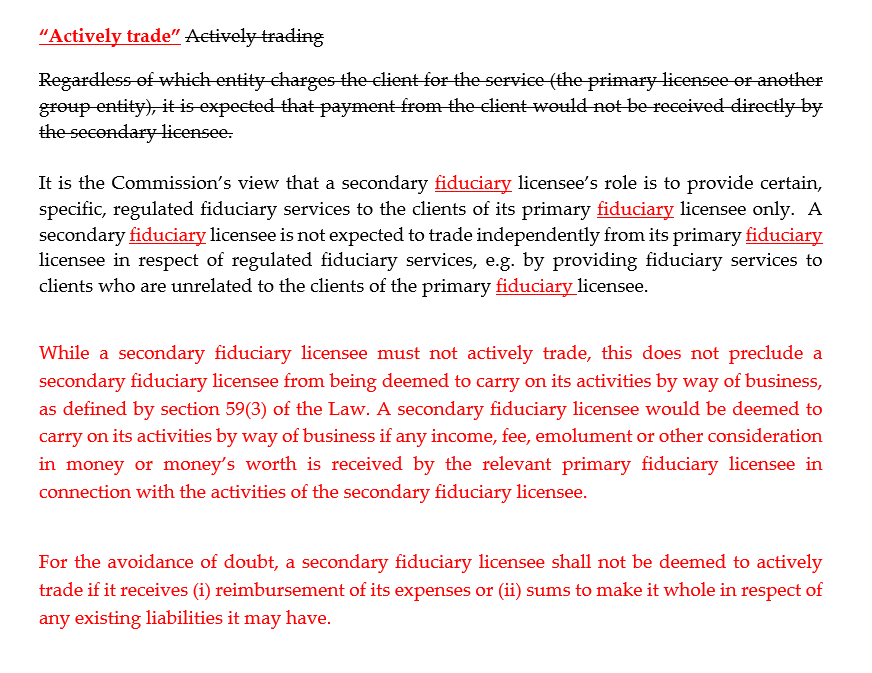

Definition of “actively trade”

Half of the respondents either had no comments on the proposed definition or provided some minor drafting suggestions. Other respondents highlighted the following points:

- Some respondents raised a concern that the proposed definition might conflict with the statutory definition of carrying on activity “by way of business”;

- One respondent suggested that the definition should be consistent with accounting recognition of income;

- Two respondents questioned the application of the draft Guidance Note on page 5 of the draft Fiduciary Rules, 2021 with respect to invoicing practice; and

- One respondent expressed the view that the proposed definition may conflict with the provisions of the Trusts (Guernsey) Law 2007 (the “Trusts Law”).

Commission response

The definition of “actively trade” and associated guidance have been amended with a view to address the concerns raised in respect of the potential inconsistency with the “by way of business” test and increasing the clarity of guidance. The definition is now more closely linked to the recognition of income from fiduciary activity on a firm’s income statement. These changes are presented below, for ease of reference:

Consultation definition of “actively trade”:

“actively trade” means to provide services to third parties, in relation to fiduciary regulated activities, for which a fee, commission, or other form of income is received directly by the licensee;

New definition of “actively trade”:

“actively trade” means to provide services, classed as regulated activity under the Law, to third parties for which a fee, commission, or other form of income is received directly by the licensee and recognised on its income statement.

Regarding the comment concerning the Trusts Law, the Commission remains respectful of the jurisdiction of the Court in relation to the Trusts Law. The Commission would like to highlight that the proposed rules concerning the prohibition of secondary fiduciary licensees from actively trading are expected to formalise the current practice whereby most joint licensees are passive and are not operating independently from a lead licensee. We believe that professional trustees are currently relying on s.24 of the Trusts Law (specifically s.24(a), (b) and (iii)) and the terms of the trusts when a lead licensee receives fee income from services provided by their joint licensees.

In addition to the above, some drafting changes have been made to rules and guidance in Part 1A to provide for consistency, as suggested by some respondents.

Requirement for a secondary fiduciary licensee to designate a single primary fiduciary licensee

The majority of respondents had no comment on the proposal. Three respondents questioned the rationale as to why a secondary fiduciary licensee is not permitted to act for more than one primary fiduciary licensee.

Commission response

Currently, each joint licensee is clearly nominated to one lead licensee. It is the Commission’s view that this current practice should continue to apply. Designation as a secondary licensee, and the regulatory carve-outs associated with designation, are contingent on the clarity provided by the sharing of common staff, procedures and clients between the two licensees. Permitting a licensee to be designated as being secondary to multiple, separate primary fiduciary licensees would pose supervisory and practical challenges including the on-going reporting obligations of the secondary licensees. For these reasons the Commission’s position remains unchanged from that proposed in the Consultation Paper.

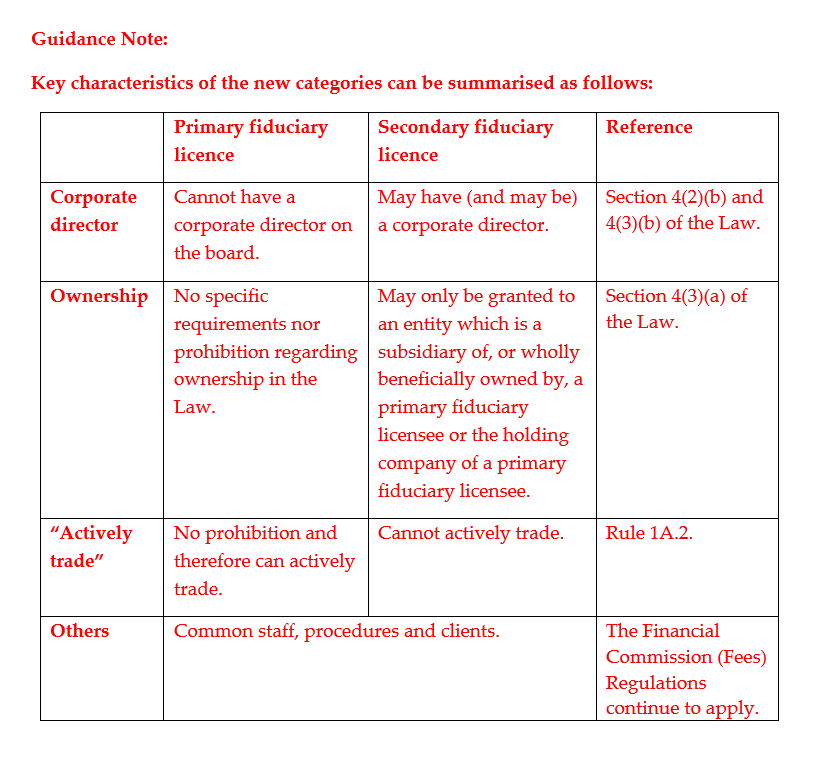

Minor changes to the draft rules have been made to improve clarity and a table summarising the key characteristics of the new categories of licences has also now been added to the Guidance Note to Rule 1A.2. The new Guidance Note (showing changes to the Consultation Paper version of the guidance note) is presented below:

The automatic re-categorisation of Joint Licensees into Secondary Licensees upon enactment of the 2020 Fiduciaries Law

Most respondents agreed with the proposed automatic re-categorisation of licences, as set out in the Consultation Paper, noting the efficiency and the reduced administrative burden on licensees. One respondent, while supportive of the proposals, raised the concern that the automatic re-categorisation of licences may create uncertainty for licensees as to whether they will become a primary or secondary fiduciary licensee upon the enactment of the 2020 Fiduciaries Law.

Commission response

On the commencement of the 2020 Fiduciaries Law on the 1 November 2021, all lead fiduciary licensees will be automatically converted to primary fiduciary licensees as per section 60(1)(b)(i) of the Law. All joint licensees will be converted to secondary licensees as per section 61(1)(b) of the Law and rule 1A.1(1)(b) of the proposed Fiduciary Rules, 2021. The Commission will be sending a notice to all full fiduciary licensees (lead and joint licensees) confirming the future conversion of licences. It is expected that in most cases no action will be required by licensees. Only joint licensees which do not wish to be re-categorised as a secondary fiduciary licensee are required to advise the Commission. In such circumstances the licensee will be required to meet all the regulatory requirements applicable to a primary fiduciary licensee. If the Commission is not notified otherwise by a joint licensee, it will be deemed that the licensee agrees to the conversion for the purpose of section 61(1)(b) of the Law.

Proposals relating to the provisions for annual returns and the removal of restrictions on advertising by PFLs.

Respondents were supportive of the proposals in the consultation paper and accordingly the Fiduciary Rules, 2021 will repeal the Regulation of Fiduciaries (Annual Return) Regulations, 2017 and the Regulation of Fiduciaries (Fiduciary Advertisements and Annual Returns) Regulations, 2012.

Other comments

The Fiduciary Rules, 2021 and their applications

Two respondents commented that certain rules in the Fiduciary Rules should not apply to secondary fiduciary licensees.

Commission response

The Commission has considered the comments and has taken the decision to retain the drafting as consulted upon. In reaching the decision, the Commission carefully reviewed the rules and deemed that they should continue to apply to secondary fiduciary licensees, where appropriate.

Under the current framework and following the enactment of the 2020 Fiduciaries Law, the lead (primary) and joint (secondary) fiduciary licensees are, and will remain, licensees under the Law. Despite having certain commonalities to their primary fiduciary licensee, a secondary fiduciary licensee is a separate legal entity from its primary and therefore should be subject to the Fiduciary Rules, where applicable.

Changes to other rules not related to the re-categorisation of licences, the annual return or the advertisement of PFLs

Three respondents suggested some changes to other provisions of the Fiduciary Rules, 2021 unrelated to the Revision of Laws process.

Commission response

The Commission notes the comments and suggestions, however, these are outside the scope of this consultation which is restricted to rule amendments arising from the revision to the Fiduciaries Law. The decision to keep the exercise limited, in this way, was made due to the large amount of work that had to be undertaken to ensure that, the Fiduciary Rules 2021, and all the other statutory instruments made under the revised regulatory laws, could be properly considered. Any new future specific proposals for policy revision would be better dealt with through a separate consultation.

Links:

Overview

Purpose of the Consultation Paper

The Commission seeks to regulate and supervise financial services in the Bailiwick of Guernsey with integrity, proportionality, and professional excellence, and in so doing help to uphold the international reputation of the Bailiwick of Guernsey as a finance centre.

The purpose of this Consultation Paper is to seek feedback from all interested parties on the proposed replacement of the current Fiduciary Rules, 2020 (and certain other associated secondary legislation as set out below) with the Fiduciary Rules, 2021.

Consistent with the Commission’s objectives, the proposals in this Consultation Paper are designed to enhance the levels of confidence and security in the Bailiwick’s regulatory and supervisory framework.

The detailed proposals are set out within this document and in the draft Fiduciary Rules, 2021 which are provided in Appendix 1 to this paper in “consolidated” form including Commission Guidance.

This Consultation Paper is a working document and does not prejudge any final decision to be made by the Commission.

For the past 20 years, Licensees and the Commission have been operating under the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc. (Bailiwick of Guernsey) Law, 2000 (the “2000 Fiduciaries Law”).

In 2020 the States of Guernsey, the States of Alderney, and the Chief Pleas of Sark, as part of a comprehensive review of the legislation governing the finance industry, approved The Regulation of Fiduciaries, Administration Businesses and Company Directors, etc (Bailiwick of Guernsey) Law, 2020 (the “2020 Fiduciaries Law”). This law forms part of the suite of amended legislation contemplated in the Policy Letter submitted by the Policy Council on the Revision of the Financial Supervisory and Regulatory Laws on the 30th of October 2015.

This underlying law change necessitates the Commission to review all associated secondary legislation to ensure it is compliant with the new law.

The Fiduciary Rules, 2020 (“the Current Fiduciary Rules”) have been in operation since 31 December 2020 and were made in exercise of the Commission’s powers under the 2000 Fiduciaries Law. These rules were introduced following comprehensive sector-specific consultation on the consolidation and revision of previous fiduciary codes.

It is proposed that the Fiduciary Rules, 2021 will repeal the Current Fiduciary Rules and also the Regulation of Fiduciaries (Annual Return) Regulations, 2017 (the “Annual Return Regulations”) and the Regulation of Fiduciaries (Fiduciary Advertisements and Annual Returns) Regulations, 2012.

Whilst the proposed new Fiduciary Rules, 2021 will largely mirror the Current Fiduciary Rules and incorporate the provisions of the repealed Regulations, there are certain proposed amendments and additions, which reflect matters which will be introduced or changed when the new 2020 Fiduciaries Law is enacted and these are considered in this Consultation Paper.

Besides amending references to relevant laws under which the Rules are made, other proposed material changes include:

- The introduction of rules to account for, and relevant to, the different and new categories of licence under the new law, and how changes of categorisation can be effected (proposals in this respect were previously made in a Commission Discussion Paper, details of which as set out below);

- Provisions for annual returns – coming from relevant regulation; and

- Repeal of restrictions on PFL advertising.

These are covered individually in the following sections of this Consultation Paper.

Contemporary Commission consultations

The Commission has also published two additional parallel consultation papers which may be of relevance to the reader of this consultation paper.

The first consultation paper[1] consults on proposed re-issuance of other Regulations and Rules reflecting the aforementioned Revision of the Financial Supervisory and Regulatory Laws. In the main, the changes proposed in that paper are minor.

The second consultation paper[2] consults on notification rules for vehicles which are ancillary to investment activity. While notification will be made under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, the activity notified will be exempt from the scope of the new 2020 Fiduciaries Law.

Audiences

- Consumer

- Financial Advisor

- Financial Services Business

- FinTech

- Lending, Credit & Finance Business

- NRFSB

- Prescribed Business

- Lenders

- FSPID Team

- ExCo

- Banks

- All staff

- ExCo

- Pension Committee

- NED Forum

Share

Share on Twitter Share on Facebook